In a surprising shift, former U.S. President Donald Trump has recently decided not to implement the anticipated changes to his earlier tariff policies.

According to a recent article by The Guardian, the expected increases were paused for most countries—except China—leading to temporary market relief, but leaving future trade strategies highly uncertain.

For private banks and financial institutions, this creates a dual challenge: managing speculative volatility even when changes don’t occur, and being perpetually prepared for sudden reversals.

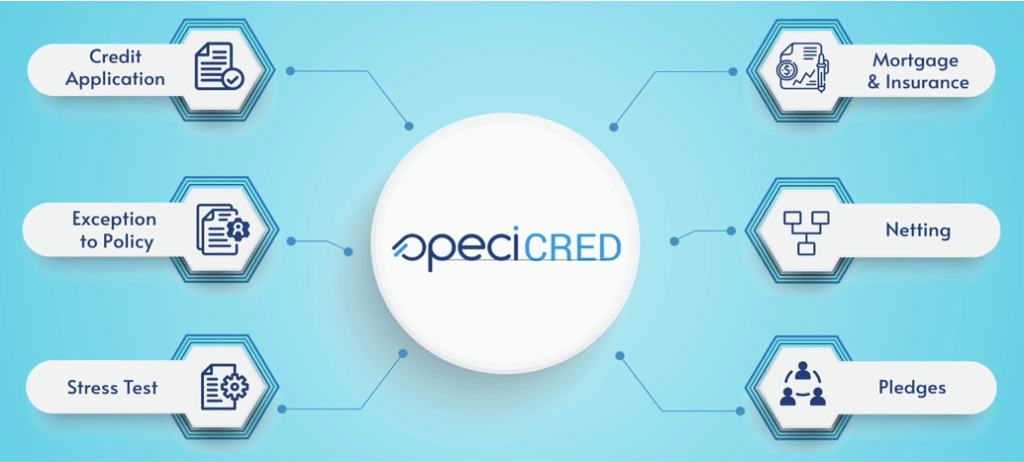

This is where SpeciCRED steps in. As the global leader in Lombard credit software, SpeciTec’s Credit Monitoring platform SpeciCRED is built to navigate policy unpredictability empowering wealth managers worldwide.

How SpeciCRED Keeps Private Banks Resilient in Uncertain Trade Environments

Our clients currently rely on SpeciCRED in three strategic ways:

Real-Time Alerts to Anticipate Market Shocks

SpeciCRED’s Breach Limit Type engine monitors live market indicators and instantly alerts your teams when predefined risk thresholds are crossed—even if actual policy changes don’t occur. Investor sentiment can shift rapidly based on political speculation alone. With SpeciCRED, you’re always one step ahead.

Stress Testing for the Unknown

Just because a tariff policy hasn’t changed doesn’t mean it won’t. SpeciCRED’s dynamic stress test simulations help banks prepare for the what ifs—sudden reversals, retaliation scenarios, or political moves that trigger market panic. These forecasts are fully customizable, empowering your teams to present clear action plans to management and clients alike.

Continuous Scenario Analysis Amidst Policy Inertia

The absence of change can be deceptive. Financial institutions must remain vigilant. SpeciCRED enables continuous monitoring of speculative impact on market value, currency strength, and commodity pricing (notably gold). This long-view helps you adjust strategies before markets react.

Why SpeciCRED Is a Must-Have in Times of Political Uncertainty

The recent policy pause is a stark reminder: volatility doesn’t require change—it thrives on speculation. SpeciCRED empowers institutions with data-driven clarity when investor sentiment swings, ensuring:

- Better client confidence

- Regulatory-ready reporting

- Sharper, faster reaction time

- Capital preservation and opportunity seizing

Ready to Navigate the Next Wave?

Even when the storm doesn’t hit, you need radar. Discover how SpeciCRED can help your teams manage speculative volatility and stay in control.

#RiskManagement #TradePolicy #SpeciCRED #MarketVolatility #PrivateBanking #PredictiveAnalytics #FinancialStability